CEO Brazil of JLL outlines prospects for the domestic property market

The pandemic is accelerating transformations and paving the way for innovations in real estate, according to Fábio Maceira.

- Agência Tecere

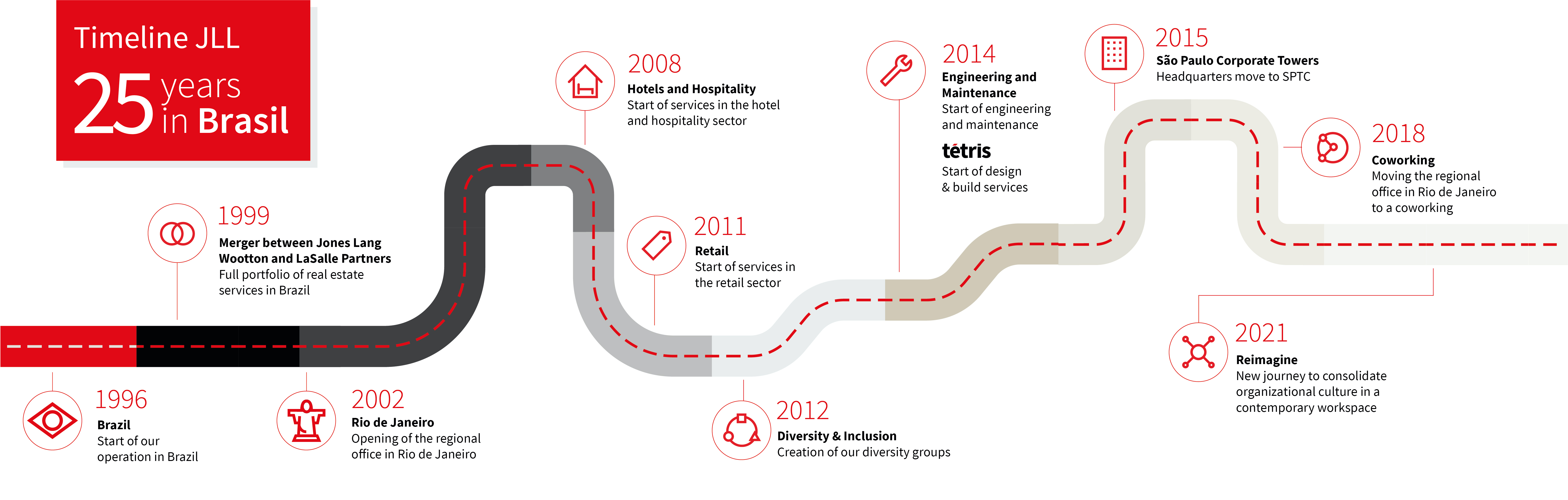

Throughout its 25-year presence in Brazil, JLL has witnessed and contributed to the evolution of the national property market. This was the case, for example, with the development of real estate funds, which expanded the options for investors and today present good yield alternatives, even in the midst of the crisis generated by the COVID-19 pandemic. This is also the case with the transformation of offices, which a few years ago went from the closed-room model to open space and are now undergoing a revolution, with the expansion of remote working and the adoption of technologies to increase efficiency in the use of space and the comfort of users.

To celebrate this story and guide the market in a moment of such rapid and profound changes, we opened space for major specialists to point out trends and directions for the next 25 years in the real estate. The interview that opens this series is with Fábio Maceira, CEO Brazil of JLL, with reflections on the different segments in which the company operates and on other pertinent business topics, such as digitalization.

From Intern in New York to CEO in Brazil

Maceira's career is intertwined with JLL's history in Brazil. Currently CEO, Fábio began his career in the company as an intern in New York, while he was taking a specialization course in Real Estate Development at Columbia University, in the United States. At the time, what was then Jones Lang Wootton was taking its first steps to enter Brazil, and was already counting on the Brazilian perspective to break into the market. From trainee, he soon became a Valuation Advisory analyst, and after a period of international experience, he finally joined the team in Brazil in 2001. He continued to accumulate responsibilities until, in 2007, became president.

In the 14 years that Fábio Maceira has been CEO, JLL Brazil has grown and gone through many changes, as has the role of the executive at the head of the business. "My main role is to find the best leaders and give them the necessary conditions to perform with their teams. Our areas have independence, and the business leadership has autonomy and freedom to develop their projects and better meet the needs of clients. Many of the companies we serve operate in several countries, so it makes sense to have one person handling the same account in different places," he says.

Check out the complete interview with JLL's CEO Brazil below.

In the last 25 years, the Brazilian property market has evolved a lot. How important was JLL for this growth?

It’s as the saying goes: when I came here, everything was just wilderness. That was about it. In these two and a half decades, the urban transformation has been incredible, and we have followed the development of the office regions in the cities. One of the first things we did in Brazil that represented a major change was to bring information to the market in a transparent way. Our Research area has always been very relevant and, with the disclosure of data such as vacancy and prices charged, we were able to bring more professionalism as we expanded access to information. Until then, there were few institutional investors and the market was very stratified. Over time, the change in legislation allowed the entry of real estate funds and publicly traded companies that invest exclusively in real estate, which also favored transparency and the evolution of the sector.

Trends for the future of work and offices

The first event in celebration of our 25th anniversary brought together journalist Débora Freitas, Washington Botelho, president of the LatAm Corporate Solutions Division, and Luiz Candreva, head of Innovation at Ayoo.

Was JLL's bicentennial history a differential for the beginning of its operations in Brazil?

No doubt about it. We helped develop the national market by bringing international standards, with intelligent buildings and focus on the user experience. In this pandemic context, therefore, relying on the expertise of an international network is especially important. We can anticipate scenarios based on the examples of other countries that are at more advanced stages in dealing with the virus and, thus, import solutions to our market.

The pandemic has accelerated the digital transformation, something that had been a reality at JLL for some time. How has this process been?

Digitalization at JLL takes place on many fronts simultaneously. We invest a lot in technology, either by developing our own tools and making them available to the market; or by buying shares in technology companies to bring new solutions to our clients; or by implementing third-party technology. Our goal is to bring innovation to the market. We do this from design and construction, with tools that allow remote supervision, through monitoring the occupation of spaces, to the use of management apps that optimize processes and increase efficiency.

After a year with offices closed, companies are rethinking their spaces and planning changes according to post-pandemic needs. What will the office of the future look like?

Offices will look different because of remote working, which is here to stay, but they will still be very relevant. Previously, around 80% of the office area was dedicated to individual work. This must evolve. From now on, the spaces will be more team-oriented, with lounges and meeting rooms, more collaborative environments dedicated to promoting organizational culture.

Will there be fewer people in the offices?

The density is expected to fall, but only because, with the hybrid working model, the office will not be used at the same time by all the employees of a given company. It should also be considered that there will be greater spacing between workstations, due to the need for distance, in addition to the provision of larger, inclusive environments focused on the well-being and experience of users. The office will be a meeting place for employees and also a location for events, to bring clients and suppliers together. These events will no longer be just face-to-face, but hybrid, with online streaming, so the spaces will have to be equipped for this. Technology comes with everything from touchless access controls and air quality sensors to prevent the spread of viruses and bacteria to applications for reserving spaces and monitoring sensors to ensure intelligent use. In addition, there are other movements underway, such as the decentralization of offices and the office pass, which gives employees a choice of places to work. In short, there are many trends emerging, all aimed at improving the efficiency of office use and increasing the productivity of teams.

The Capital Markets area has been standing out in the company, with the segment showing some resilience even in the midst of the crisis. How do you evaluate the current opportunities for real estate investment?

Financial instruments such as CRIs, real estate funds, and publicly traded companies that invest in real estate have brought the property market to another level, with greater liquidity. Currently, with the Selic rate at 2.75% a year, one of the lowest levels in history, real estate is a class of assets that provides an interesting return, with the combination of appreciation of the property and income.

Shouldn't the scenario be exactly the same for the different types of real estate assets?

There are options with better performance at the moment, such as supermarkets, which offer income predictability, and logistics warehouses, which have positive pressure for rent increases and prospects of expanding returns. It is even a good time to enter the hotel segment, taking advantage of the cheaper assets. Capital Markets will continue to grow.

Looking for more insights? Never miss an update.

The latest news, insights and opportunities from global commercial real estate markets straight to your inbox.

In the logistics segment, the pandemic has had a positive impact thanks to the growth of e-commerce and new last mile requirements. What developments can we expect from this in the market?

Consumer habits have changed, and the client is not willing to wait for certain products. The main transformation is in the speed of delivery. This increases the use of urban real estate in the logistics chain, getting closer and closer to the consumer. Thus, in addition to the dark warehouses [not identified by brands], locations that acted only as a retail point became distribution points. It is a balance to be struck: if it is kept in the store, which is closer, the costs of a point of sale have to be included, such as rent at a prime location and air conditioning. If the stock is kept in an out-of-town distribution center, it is cheaper, but the delivery is not fast.

Another important point is the environmental impact.

Exactly. The consumer is increasingly demanding and looking to know where the product they buy comes from, how it is distributed and what the impact of this is. There is a trend towards local consumption to reduce the carbon footprint, which also appeals to investors with an eye for ESG (Environmental, Social and Corporate Governance). Much innovation is still to come in this segment, with the use of non-polluting vehicles and improvements in the security of the delivery process when the client is not at home, for example. And despite the growth in demand for urban real estate for logistics purposes, the demand for large warehouses will continue to grow, as companies need spaces to store their inputs and safeguard production.

While the logistic warehouses continue full steam ahead, the hotel industry, on the other hand, is adapting to get through this unprecedented moment in tourism. What are the prospects for the sector?

Business hotels, which are the majority in Brazil, are facing the restrictions on corporate travel and the suspension of events such as congresses and conventions, and this could make room for other opportunities. In the future, I estimate that some of the hotels will be reconfigured for long-term stays, with a more residential appeal, improving integration with the city and decreasing the amount of spaces restricted to guests only. This will make the hotel into something more dynamic, with another mix of services. Today, many hotels are already wagering on the staycation concept to attract clients interested in leisure and wellness services.

The 25th anniversary of JLL in Brazil is taking place exactly during this time of so many transformations in the world, driven by the pandemic. What do you expect for the next 25 years of the company?

JLL is constantly evolving. What we are today is very different from what we were 25 years ago, and I believe that the future will also be very different. Technology and transparency are the main influencers of change. Brazil will go through an economic expansion in the coming decades, with the ups and downs of a developing nation. The country has very great potential, including for the growth of our business. Our service mix will probably change, with areas that are more important today losing some relevance and also the opposite happening.

Will new lines of business emerge?

We are always on the lookout for opportunities. In the multifamily area, for example, which are professionally managed residential buildings for leasing, we have a lot of strength abroad, but this is practically non-existent in Brazil. I believe that the living sector will be a new area for us to operate in the country, due to the changes in people's consumption habits. Furthermore, another opportunity that I foresee is the intermediation of real estate financing. This has evolved a lot in the country in the last 25 years, with the control of inflation, and will continue to develop, which opens up more possibilities for us in all real estate segments.

And until then, new transformations will come...

Just as offices and cars have already undergone this revolution of flexibility, with the possibility of renting for occasional use, the same will happen with housing. The dynamics will change, the dream of home ownership will give way to the possibility of living wherever you want, renting furnished or semi-furnished apartments, with or without services included, for as long as you need. The new generations will not want to live in their assets; they will prefer to invest the capital, have an income that way, and pay rent in exchange for mobility. There is still a lack of organization and financing for this market to develop in Brazil, but I believe that these conditions will be met in the next 25 years. The summary is: there are good prospects for growth in the sectors in which we already operate and in those in which we are yet to operate.